Tax reliefs, bonuses and investment incentives

In order to assist local businesses and stimulate new investments, Racibórz introduces various tax reliefs and incentives. There are also business support programmes intended to provide post-investment guidance, as well as assistance throughout the investment process.

All investors have also access to regional and central tax relief schemes. Detailed information can be found on: http://invest-ksse.com/ksse-1161 (Katowice Special Economic Zone) and PAIH (Polish Investment and Trade Agency) https://www.paih.gov.pl/en websites.

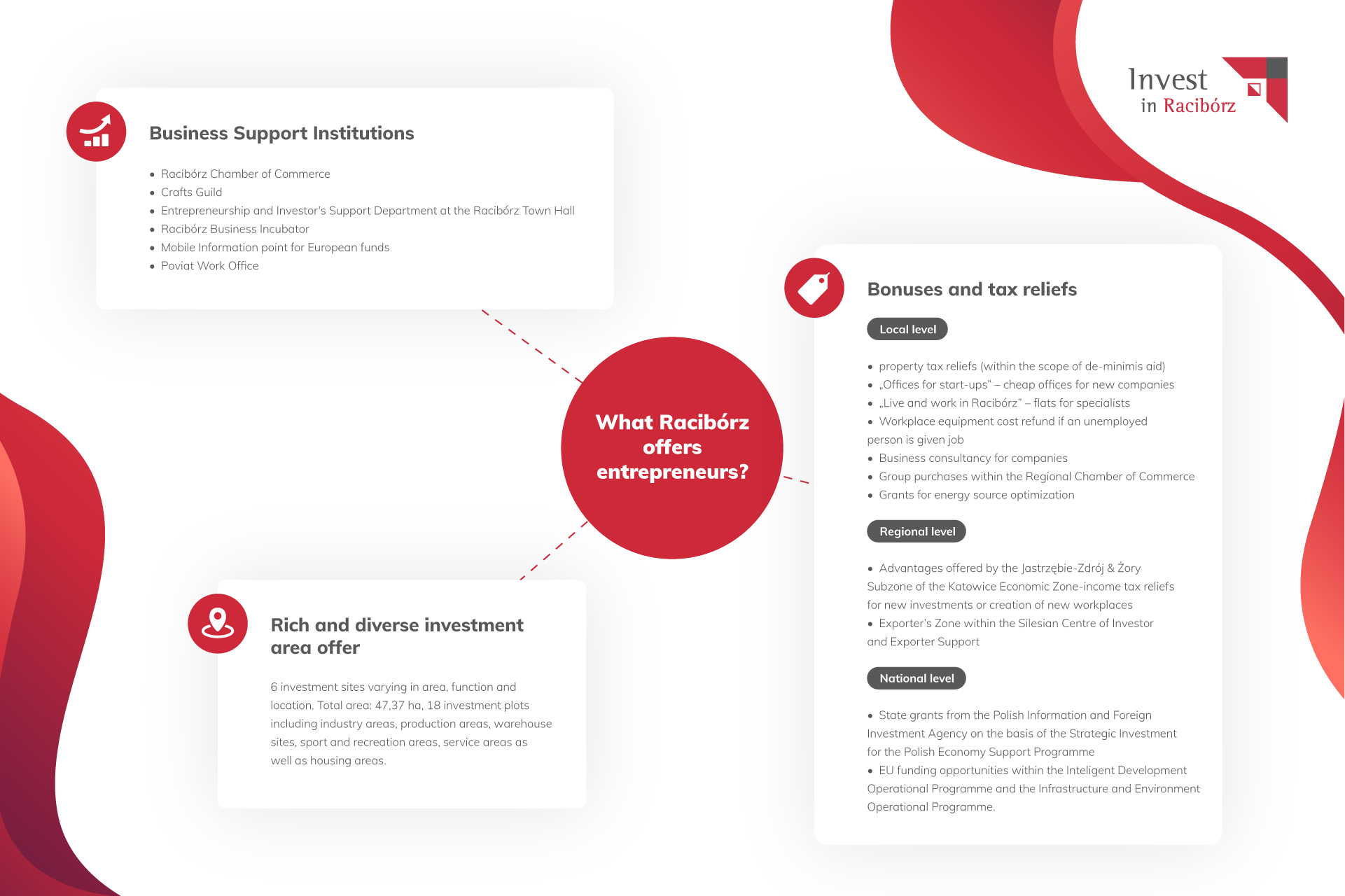

Infographic showing the possibilities of business support

Tax reliefs and incentives

Local level

Property tax reliefs within the scope of de-minimis aid

The Town of Racibórz has offered local businesses property tax reliefs for several years now. The legal basis is provided by the resolution of the Town Council no XLI/576/2014 dated 25th of June czerwca 2014. The reliefs are granted within the scope of de-minimis aid, as defined in the EU Commission no 1407/2013 dated 18 December 2013 r. on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid (Official Journal L 352).

The property tax reliefs are available for:

- Newly erected buildings used for business purposes,

- Existing buildings that have been rebuilt or extended on the basis of an obtained building permission in which no active business operation has taken place for the last 3 years. Tax exemption applies only to a part of the building that has been rebuilt.

The maximum tax exemption value cannot exceed 50% of proven costs of the building reconstruction or extension during a period of 3 years.

Please, bear in mind that:

An entrepreneur is a natural person, a legal person or an organisation, which does not have a legal personality but is granted legal capacity by another Act, who professionally undertakes and conducts a business activity in its own name. The partners of a general partnership are also deemed to be entrepreneurs in the area of the business activity they conduct.

Legal acts related to de minimis aid

Resolution No XLI/576/2014 on property tax reliefs within the scope of de minimis aid. Details related to this financial instrument can be found on https://www.uokik.gov.pl/pomoc_publiczna.php

„Offices for start-ups”

„Offices for start-ups” is a programme where office spaces are made available to micro and small companies operating in the market up to 3 years and to businesses with an academic background. The offices located in the local Centre for Economic Development, as well as in other parts of Racibórz dedicated to this purpose by the President of Racibórz. The programme includes a rent-free period of 18 to 24 months from the signature of the rental agreement.

More information on this programme, together with the list of available locations can be found here

https://www.raciborz.pl/dla_inwestorow_i_przedsiebiorcow/Lokale_na_Start

Business Incubator

The Racibórz Business Incubator, operating in the local Centre for Economic Development, provides consultancy and support for local businesses, including training sessions and courses, information and education, meeting with consultants in various fields, such as:

- financial grants for SMEs and people planning to set-up their companies,

- financial support instruments offered by the Dis trict Employment Agency,

- investment support offred by Business Angels or Venture Capital,

- modern marketing methods,

- finance and accounting in a small company,

- social media, marketing and PR,

- business models,

- crowdfunding.

The Business Incubator offers supports to companies operating in Racibórz as well as people interested in starting a business as students and graduates who are ready to realize their business plans. More informations you can find here: https://www.przedsiebiorczyraciborz.pl/inkubator-przedsiebiorczosci-w-raciborzu/

Entrepreneurial Racibórz

Entrepreneurial Racibórz is something that can be called a local business ecosystem allowing entrepreneurs based in Raibórz to promote their businesses in the local environment, gain access to various information related to business operation communicate with town authorities and other institutions active in the local labour market, such as the Inland Revenu Office, the Employment Agency or the Social Insurance Office. More information is available on http://www.przedsiebiorczyraciborz.pl/ or on the Facebook profile of Entrepreneurial Racibórz https://www.facebook.com/PrzedsiebiorczyRaciborz/?fref=ts

Group purchases within the Regional Chamber of Commerce

Members of the Regional Chamber of Commerce can take part in various initiatives aimed at promoting their companies and their products. The members have also access to specialist courses and training sessions. Group purchases of gas and electricity are also carried out allowing companies to get more competitive utility prices. More information is available on http://www.rig-raciborz.pl/site/index/68-aktualnosci/1-informacje-biezace/news/417-grupowy-zakup-energii-elektrycznej-na-2017r--.html

Grants for energy source optimization

Local companies can obtain grants for optimization of energy sources in their companies (boiler replacement or heat pumps/solar thermal panels for hot water treatment). Grants are given on the basis of a written application submitted to the Environment Departnement of the Municipal Office in Racibórz with all necessary attachment. The application shall be submitted to 31 October of each year.

„Live and work in Racibórz!”

Within the scope of the programme, flats are made available to specialists working for companies based in Racibórz. Applications can be made by employers on behalf of their employees for the duration of their employment. Applications can be submitted twice a year, on the basis of a resolution of the Town Council: http://www.bipraciborz.pl/bip/dokumenty-akcja-wyszukaj-idkategorii-64121?komunikat=12126090

Application forms and a list of available flats can be accessed on the following website: http://www.bipraciborz.pl/bipkod/12773738?komunikat=12797435

Employment support offered by the District Employment Agency in Racibórz

The District Employment Office in Racibórz provides various forms of support for employers including:

- employee search assistance,

- courses and training sessions for employees,

- workplace equipment cost refund if an unemployed person is given a job,

- and other support schemes.

Detailed information can be obtained from the District Employment Agency in Racibórz, ul. Klasztorna 6, telephone no. +48 (32) 415 45 50 [internal no. 218 or 219] or on the Employment Agency website: http://raciborz.praca.gov.pl/dla-pracodawcow-i-przedsiebiorcow/

Regional level

Jestrzębie Zdrój-Żory Subzone of the Katowice Special Economic Zone

Investing on sites included within the portfolio of the Katowice Special Economic Zone companies are entitled to income tax reliefs based on the investment value o number of create workplaces.

1. Tax relief based on investment cost:

- maximum tax relief fo large companies is 25% of the overall investment cost.

- maximum tax relief for small and medium entreprises is additionally increased by 10 and 20% respectively.

2. Tax relief based on newly created workplaces:

- maximum tax relief is 25% of a two-year employment cost of all newly created workplaces.

- maximum tax relief for small and medium entreprises is additionally increased by 10 and 20% respectively.

Racibórz is currently making attempts to extend the area of the Katowice Special Economic Zone within the town borders. Investment site of 7,5ha in ul. Cecyll and ul. Komunalna is likely to be included within the Economic Zone portfolio soon. More information about this investment site is available here:

https://www.raciborz.pl/invest_in_raciborz/ul_Cecylii

Detailed information concerning the Katowice Special Economic Zone is available on their website: http://invest-ksse.com/ksse-1161

Exporter’s Zone within the Silesian Centre of Investor and Exporter Support

It is a project run by the Ministry of Economy offering support for Polish production companies willing to start or develop their export activity. The support is offered by the Promotion, Trade and Investment Departments of 48 consular offices and embassies worldwide.

Basic aims of the project include the increase of international presence of Polish companies by facilitating their access to complex advice and assistance related to export and foreign investments.

Detailed information is available on http://www.invest-in-silesia.pl/?page=strefa-eksportera

Silesian Regional Operational Programme for the years 2014-2020

It is one of 16 Regional Programmes that forms the basis for the distribution of EU grants within the EU budget for the period 2014-2020. Within the scope of the programme companies can access the following funding routes:

- action 1.2 – Research, development and innovation in SMEs,

- action 3.2 – Innovations in SMEs,

- action 3.3 – IT technologies in business operation,

- action 4.2 – Energy efficiency and renewable energy sources in SMEs.

Detailed information is available on the Regional Programme Website: www.rpo.slaskie.pl

or the Silesian Centre for Entrepreneurship which is an institution responsible for SME-oriented projects: www.scp-slask.pl

National level

the Polish Investment and Trade Agency – State grants

State grants are given on the basis of the Strategic Investment for the Polish Economy Support Programme for the period 2011 – 2020 accepted by the Polish Government on the 5th of July 2011.

Grants are given on the basis of a bilateral agreement between the Minister of Economy and the investor.

Detailed information together with the relevant application forms is available on the website of the Polish Investment and Trade Agency: http://www.paiz.gov.pl/

the Intelligent Development Operational Programme

The Intelligent Development Operational Programme is a very important instrument in the implementation of the 2014-2020 financial perspective, especially in the field of innovation, research and development and the implementation of "smart specialization strategies". The basic assumption of the programme is “from the idea to market implementation”.

More information on the programme to be found on: www.poir.gov.pl

the Infrastructure and Environment Operational Programme

The Infrastructure and Environment Operational Programme 2014-2020 is a national programme to support low carbon economy, environmental protection, adaptation to climate change, transport and energy security. EU funds from the programme will be used also for investment in the health and cultural heritage areas.

More information is available on the programme website: https://www.pois.gov.pl/

Horizon 2020

Horizon 2020 is the biggest EU Research and Innovation programme ever with nearly €80 billion of funding available over 7 years (2014 to 2020) – in addition to the private investment that this money will attract. It promises more breakthroughs, discoveries and world-firsts by taking great ideas from the lab to the market. More information on the programme to be found on: https://ec.europa.eu/programmes/horizon2020/en/what-horizon-2020

Updated: 2019-07-24